Due to the lockdown regulations imposed between April and June of this year, construction activity in South Africa followed the sharp downward trend of virtually every other sector.

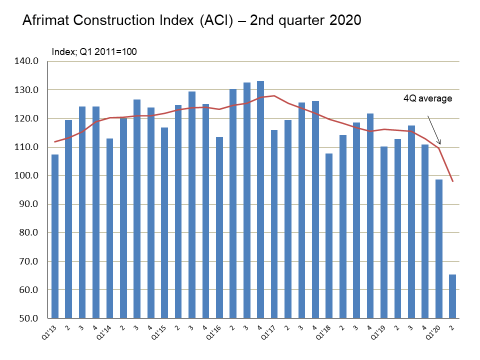

Afrimat, the JSE-listed open pit mining company providing industrial minerals, bulk commodities and construction materials, has released the findings of the Afrimat Construction Index (ACI) for the second quarter of 2020. The ACI is a composite index of the level of activity within the building and construction sectors, compiled by renowned economist Dr Roelof Botha on behalf of Afrimat.

Due to the lockdown regulations imposed between April and June of this year, construction activity in South Africa followed the sharp downward trend of virtually every other sector. Prior to the COVID-19 pandemic, the sector had been battling with low levels of business confidence, high interest rates, declining levels of public sector expenditure on infrastructure and lethargic economic growth in general. When the lockdown came, the sector temporarily almost ground to a halt, with April recording insignificant levels of activity for every key indicator relevant to construction.

It was predictable, therefore, that the ACI would drop to well below the level of 100 (representing the base period for the index), which also occurred during the first quarter, when the ACI dropped to below the level of 100 for the first time.

Gross domestic product (GDP) figures for the second quarter released by Statistics SA on 8 September 2020 indicate that construction fared the worst of any sector, declining by more than 30% compared to the same quarter in 2019 (at current prices). For the economy as a whole, the nominal decline in GDP amounted to 14,8% (year-on-year).

Fortunately, however, the systematic easing of lockdown regulations has led to a V-shaped recovery for most key sectors of the economy, most notably retail trade sales by general dealers, which were already 2% higher in June 2020 than the same month a year earlier (at current prices). The same trend holds true for retail sales by hardware stores, which recorded year-on-year growth of 4% during June 2020.

The volume of building materials produced nevertheless remained subdued throughout the second quarter and is only expected to show a meaningful recovery during the third quarter of the year. Contractors and builders are obviously under huge pressure to catch up on lost construction time and the imminent further relaxation of lockdown regulations could pave the way for a bumper fourth quarter for the construction sector. Overtime work will also be facilitated by the return of the summer. During December, the interior of the country enjoys almost 14 hours of daylight.

Dr Botha stresses that the ACI’s trend for the second quarter is abnormal, and should not be mistaken for a likely future trend. “After a disappointing downward trajectory during the latter stages of the Zuma-administration, the ACI started to regain some stability from the first quarter of 2018 onwards. Prior to 2020, the ACI had permanently been above the base period level of 100. During 2018 and 2019, the value of the ACI was 14% higher than in the base period, i.e. the first quarter of 2011.

“The fact that construction activity declined as dramatically as it did is not only related to the stringent lockdown regulations, but also to the small size of the sector’s direct contribution to GDP, which is currently only 3%. However, the construction sector is a crucial enabler of downstream economic activity, especially as it pertains to capital formation. This is one of the reasons why infrastructure development has been identified by Government as a key priority for the economic recovery plans.”

Botha adds that a number of potentially strong growth drivers have started to emerge in the aftermath of the worst stages of the pandemic and these promise to boost construction activity during the rest of the year and into 2021. They include the following:

- Lending rates have dropped to their lowest level in several decades and, if sustained, will lower the cost of capital formation over the next couple of years. According to Botha, the growth-enhancing impact of lower interest rates should not be under-estimated. He points out that an econometric study conducted by Professor Ilse Botha from the University of Johannesburg (commissioned by the Optimum Investment Group) has indicated that an average real prime overdraft rate of 3,7%, as opposed to the average of 6% prior to the switch in monetary policy could add more than R100-billion to the value of outstanding mortgage loans over the next eight quarters.

- Arguably the most important tangible driver of recovery in construction is the infrastructure drive by Government, which will be implemented in close cooperation with the private sector. During a briefing at the end of July, Dr Kgosientsho Ramokgopa, Head of the South African Presidency’s Investment and Infrastructure Office, announced that details of 51 infrastructure projects had been gazetted. These projects have been declared strategically important and will be fast-tracked to secure the necessary approvals (including municipal rezoning and water rights) by the end of September.

Work on the projects should start before the end of October 2020, or at the very least tenders should have been issued in this time. The priority being assigned to these projects are directly related to the urgent need for employment creation and economic revival following the havoc caused by the coronavirus crisis. An amount of R340-billion has been earmarked for these projects and the necessary sovereign guarantees and approvals for increased borrowing have already been secured, whilst funding has been agreed with private sector banks and development organisations. Key areas of implementation are water and sanitation, energy, transport, agriculture, and affordable housing.

“Construction is the most labour-intensive sector in the economy and the high priority that has been assigned to affordable housing projects has the potential to re-energise a pervasive supply chain that is not reliant on imports, with value being added by domestic businesses,” says Botha.

Botha is confident that the construction sector has already started to lay the foundations for an exceptionally strong performance during the second half of the year and that the macro-economic dividends from National Treasury’s new growth plan will become visible in 2021.

According to Afrimat CEO, Andries van Heerden, this bodes well for the recovery of the South African economy post COVID-19, which is pleasing.

“Fortunately though, there have been opportunities in the crisis, as testified by our recent acquisition of Coza Mining to bolster our iron ore operations and increase our footprint in the Northern Cape and the offer for the remaining shareholding in Unicorn Capital Partners, in particular the Nkomati anthracite mine. We are ready for the infrastructure projects to roll out and remain hopeful that Government will act speedily on this for the sake of the people of South Africa. Our entrepreneurial culture and hands-on management style have also played to their strengths over the past few months in terms of being on the constant lookout for suitable opportunities, and ensuring these are acted on.”