From enjoying a surge in infrastructure development in the run up to the 2010 Soccer World Cup, chalking up billions of rands in government infrastructure spending, the South African construction industry has suffered a change of fortune in the last decade. Besides the pandemic, the slower growth comes amid a standstill in infrastructure project flows on the back of reduced government spending.

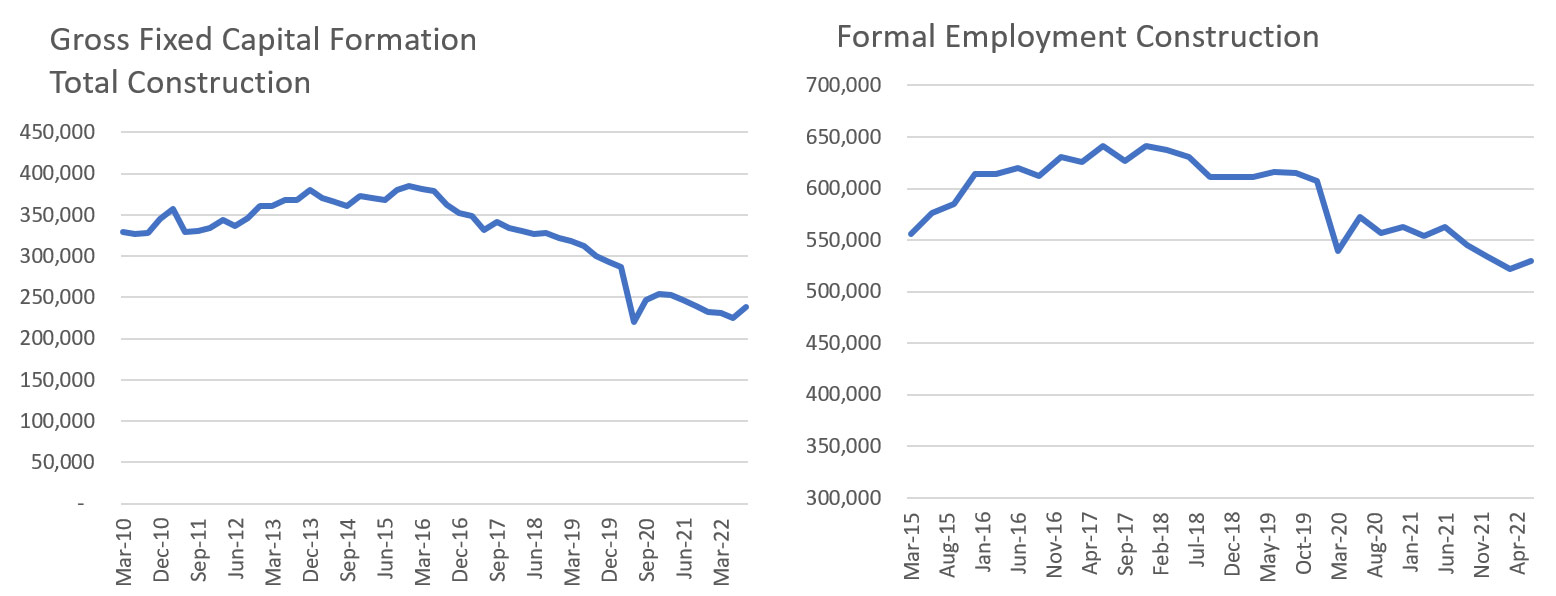

The construction industry, says Snyman, has been in decline since 2014, with 2013 being the last year to record any noteworthy growth (6,7%). Since then, the industry has declined by an average of 3% per annum, barring the 17% pandemic-influenced drop in 2020.

“The local construction sector is battered; even following the dismal performance in 2020, investment still declined by a further 3,6% in 2021. The trend continued into 2022, with a 6% decline during the first three quarters of the year, influenced by a sharp double-digit decline in investment in non-residential buildings and close to a 10% drop in construction works. However, investment in housing increased by 8,5% in 2021, off the back of a solid real estate market, supported by a lower interest rate environment and the rally in the DIY market at the time,” says Snyman.

Growth, she says, however, slowed to 0,7% for the three quarters in 2022 as higher lending rates cooled down demand for DIY spending.

Formal employment in the construction sector fell by 5% on average during the first three quarters of 2022, according to Stats SA’s quarterly employment survey, showing the sharpest decline compared to the other economic sectors. This, she says, confirms how the construction sector is bearing the brunt of the current economic catastrophe.

2023 outlook

So, what can the industry expect in 2023? It is important to note that global economic growth is projected at only 3% in 2023, with the local South African economy unlikely to breach a 1% growth rate.

“The outlook for 2023 is a mixed bag of optimism and realistic expectations. Lack of infrastructure investment by the public sector has finally caught up, adding significant strain to the local economy, affecting every fibre of economic sustainability, thus slashing hopes for an economic recovery,” says Snyman.

Government, she adds, simply cannot continue on the path of disinvestment. With the 2024 elections around the corner, it will face serious repercussions at the polls if there is no sign of serious re-commitment to improving the state of infrastructure in the country. In its October 2022 Medium-Term Budget Policy Statement, the Ministry of Finance alluded to the urgent need for infrastructure investment. On the back of this acceptance of defeat, government is finally opening investment corridors for the private sector.

New trend

The growing contribution of the private sector in economic infrastructure is expected to have a positive impact on the construction industry in 2023. As existing infrastructure continues to collapse, says Snyman, government has finally realised that it cannot do it alone.

In its recent report, Industry Insight notes that the lack of involvement by the private sector in critical economic infrastructure development has been highlighted as a major constraint for investment and economic growth. Over the years, government has maintained its stronghold on the supply of energy, rail and water resources, despite failing dismally to maintain these assets. Until it no longer had a choice.

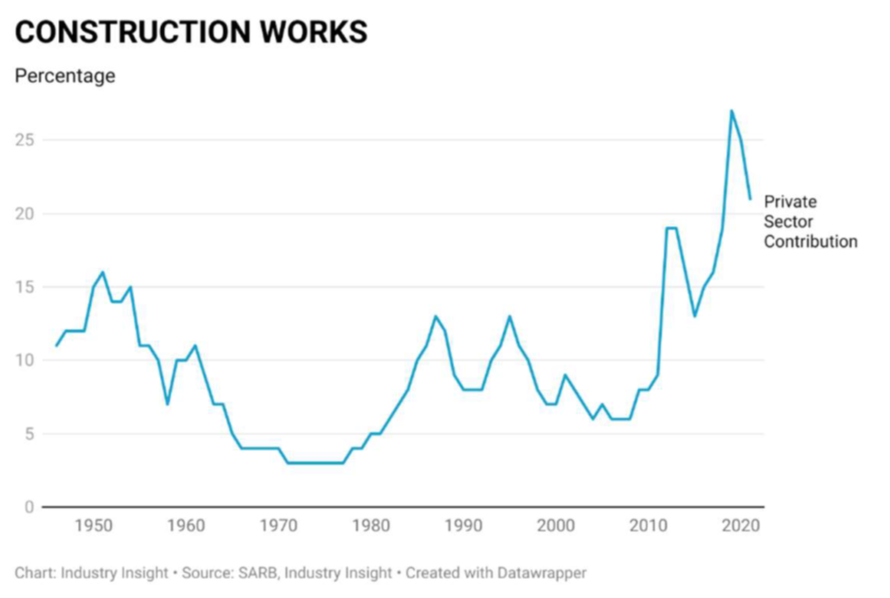

According to the South African Reserve Bank, the private sector invested close to R120-billion in construction works (typically economic infrastructure) over the three-year period 2019 – 2021, increasing its contribution to an average of 24% compared to a 20-year average of only 10%.

“For the first time we are seeing a more earnest approach by government to include the private sector in economic infrastructure development, and we hope that the renewable energy sector is just the beginning,” says Snyman. “There is still a long way to go, and we do not expect a quick turnaround in the construction sector, but at best we hope that the rate of decline will start to stabilise with some (albeit limited) growth prospects over the next three years.”

The estimated value of civil projects out to tender increased by 30% in 2022, and could support investment growth in 2023, coming off a low base, she says. Tender activity in terms of the number of projects out to tender, remains depressed (down 19% year-on-year in 2022) meaning there are fewer but higher value projects out to tender.

“This should offer some reprieve to the larger contractors, but as we have seen in recent times, these projects don’t always benefit local contractors. A case in point is SANRAL’s recent awarding of multibillion rand projects to Chinese contractors,” she says.

As of October 2022, the industry recorded about R251-billion worth of high-impact projects that were announced during the year. This includes the R75-billion green hydrogen project announced in January 2022. Projects announced during last year were by far dominated by the renewable energy sector, followed by mixed-use developments.

“There is some capex coming out of the mining sector – given the improved performance in that industry – that will benefit the construction industry. The challenge with these projects is the lengthy timelines associated with the multi-billion-rand projects,” she says.

Snyman adds that the bulk of the high value projects announced in 2021 was dominated by the industrial sector and some of the large-scale developments have since come off stream. Industrial construction activity remains strong, and this is probably the only sector in the commercial sector that is showing any potential for growth.

Key priorities

Snyman notes that spending budgetary allocations remains a serious challenge, particularly within local government. It will therefore be critical to ensure that local governments, including Metropolitan areas, have the necessary capacity to plan and implement the necessary infrastructure programmes.

The construction industry, she adds, has also had to endure a significant increase in risk over the past few years, while having to deal with near record low profitability levels. “This is simply not sustainable, and we hope that the sector will receive higher levels of government support to mitigate some of these risks, particularly when it comes to extortion by the so called ‘business forums’ that are doing nothing else but promoting criminal behaviour,” concludes Snyman.